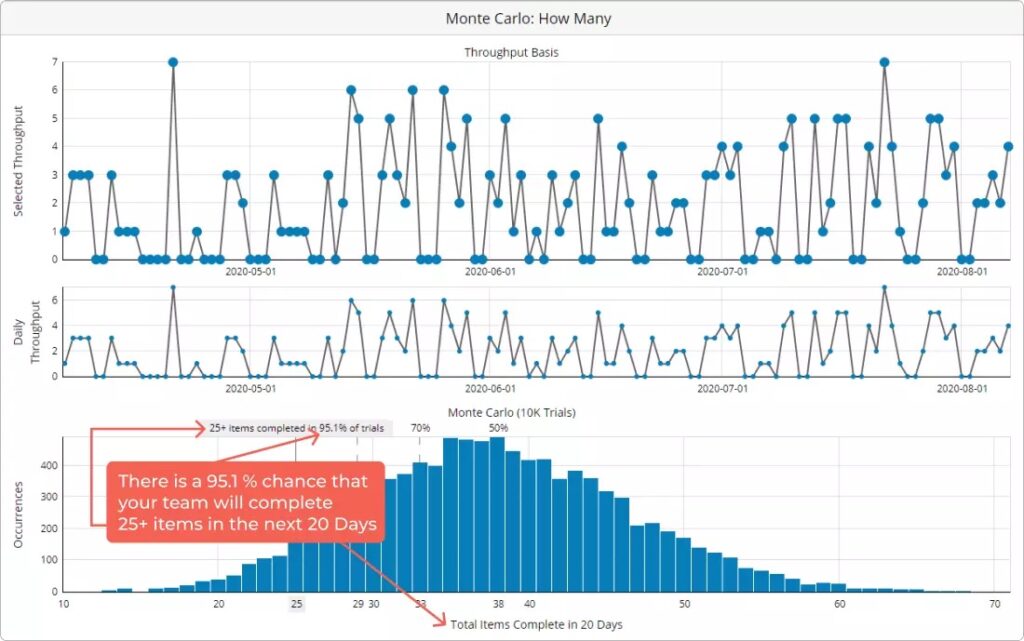

How to apply the Monte Carlo method

The Monte Carlo method is an effective way of managing risk. Experts from different fields work together to run a large number of tests. This allows you to see the possible outcomes of actions under the influence of different factors. The method provides analyses of possible scenarios and probability distributions to understand the risk system.

This type of analysis is most commonly used in the investment and financial sectors. It helps to evaluate different scenarios and prepare for certain options. This analysis consists of many random tests that provide a comprehensive picture of the risks. It works according to the law of large numbers – the more tests, the more accurate the result.

Advantages of the approach

The Monte Carlo method is a powerful forecasting tool in the investment arena. Thanks to it, companies can see the impact of various factors on the final result. It also provides the company with quality data to make informed decisions about the development of activities.

Method advantages:

- flexibility in analysing complex models;

- reliability of results;

- realistic risk assessment;

- quality data for strategic planning.

Despite its advantages, the method has a number of disadvantages. Accurate modelling requires accurate historical data or expert judgement. Simulation involves a large number of calculations, which is labour-intensive. In addition, the process itself requires resources, both financial and time.

To use the method effectively, specialised software solutions are available. These applications permit you to build processes and manage financial estimates as efficiently as possible. They support a wide range of analytical and user-defined distributions to ensure accurate results.

Application of the method

Simulation can solve problems in a variety of industries. For the financial sector, test results help manage cash flows and make profitable investment decisions.

For project managers, Monte Carlo helps anticipate potential difficulties the team may encounter during implementation. In addition, it facilitates the optimal allocation of time to tasks, taking into account possible uncertainties.

The analysis is also useful for supply chain management. It can model different variants of the interrelationship of specific processes and operations. In healthcare, the method is used in clinical trials.

Simulation provides specialists with data on which to build a strategy. The technique transforms uncertainties into clear indicators that influence future actions.

In the energy sector, too, simulation is increasingly in demand. It allows detailed calculation of project implementation parameters and payback periods. Moreover, the method makes it possible to minimise the impact of negative factors associated with market changes. This, in turn, protects investments and accelerates project payback.